We have been with Christian Healthcare Ministries for about five years. It’s been a journey but one of the best decisions we have made for our health, spirits, and wallets. Here is everything we’ve learned and what you should know before signing up.

Just about five years ago, we quit traditional insurance.

There were many factors that built up to this decision, but overall, we felt we needed to find something with better coverage and prices than what traditional health insurance was offering us.

We researched health shares as a health care alternative for months, and in the end, we settled with Christian Healthcare Ministries. This was a new concept to us, and at first, we weren’t sure we trusted it would work.

What We’ve Had Covered with CHM

Over the past five years, we have used CHM for various medical bills – some that were simple and others that would have felt catastrophic to pay. While the process sometimes feels a bit arduous, in the long run, we have saved a lot of time, money, and frustration.

Surgery with CHM

In 2018, we had two surgeries that we had to pay for, and they weren’t cheap. I was so grateful to God that we had found this membership-based program that allowed us to pay for these surgeries.

My son had to have his adenoids removed, as well as ear tubes placed, and I ended up have laparoscopic surgery to diagnose and excise endometriosis.

These surgeries were the the first time we had to negotiate bills, convince medical providers that they would actually get paid, and, most importantly, submit our bills to Christian Healthcare Ministries for reimbursement.

To say I was nervous was an understatement. If somehow it all fell through, we would end up with tens of thousands of dollars of medical bills.

I will admit at times that I thought, “Insurance would be easier!” but when all was said and done, I am SO grateful that we’ve had Christian Healthcare Ministries as opposed to traditional insurance to help protect us from financial difficulties.

Throughout the entire process for both surgeries, CHM was professional, accommodating, and quick to respond – which I can say is not very common when it comes to handling medical bills.

Pregnancy with CHM

In 2019, I also experienced pregnancy and childbirth while using Christian Healthcare Ministries, which I recount in this post, but has also given me additional experience into CHM. It was overall extremely positive, and in the end, I paid ZERO dollars for my entire pregnancy, including having a few complications.

Illness with CHM

We have had various illnesses that we’ve submitted bills for. Often, our bills aren’t reaching $400, and since we use a Direct Pay Office for our health care, typical illnesses are pretty inexpensive.

However, our youngest son got RSV at the beginning of 2020. He had various urgent care appointments, X-Rays, and, eventually, a three-day hospital stay. We had no issues whatsoever getting this bills reimbursed, and I was so grateful!

With all that said, I wanted to share an in-depth review of our experience with Christian Healthcare Ministries – specifically when it came to the two surgeries we had done. I can honestly say now that going with CHM is one of the best decisions I’ve made.

Faith Requirements

Christian Healthcare Ministries does require you to prescribe to Christian beliefs and a certain standard of living. When we signed up, we felt comfortable with what their statement of faith said. Earlier this year, they changed it a little bit, and as such, we have been considering switching to a health share for Latter-day Saints.

Christian Healthcare Ministries Cost

First off, I wanted to share how much we pay per month for Christian Healthcare Ministries.

We have chosen to go with their Gold Plan, which is $172 a month per person. However, after the third member of the family, you do not pay anything else. They have a Silver and Bronze plan – and you can compare the costs and benefits here.

So for our family of four, we pay $516 a month. Even if we had 10 more children, that’s all we would pay. This is how insurance used to work (thankfully for my parents who had six kids at home at one point!).

We also pay a quarterly gift of, I think, $75 to be a part of the “Brother’s Keeper” program, which essentially gives you unlimited sharing on incidents (instead of the $125,000). If you on the Silver and Bronze plan, it increases the amount by $100,000 per unit that is on the account and pays for Brother’s Keeper (up to 1 million).

Although optional, I try and donate a small, tax-deductible donation to the “Prayer Page” each month. This goes to help people pay bills that aren’t shared by CHM (typically due to pre-existing conditions).

Pre-Approval Process

CHM doesn’t require any pre-approval before you submit a bill for surgery. However, I felt like it was a good idea just to check that everything looked okay before I scheduled my surgery.

Surgery is expensive, and if for some reason they wouldn’t share the bills (not eligible under their sharing guidelines, it’s a pre-existing condition, etc), that’s something you would want to know upfront.

With both of the surgeries, we had done the hospital required some kind of payment upfront for being a self-pay patient. The hospital where Oliver had this surgery required around $3000 and the hospital I had surgery at actually required ALL of the amounts up front. They offered a 60% discount – but it was still over $16,000, which is a lot of money just to hand over.

We were able to work with CHM to make these payments. When you are able to secure a large discount up front that will lower the costs substantially, CHM will sometimes be able to expedite payment. However, you need to give them plenty of notice.

Because of this, make sure you know what your medical provider or hospital requires up front. You need to make CHM aware immediately of any discounts that would disappear if you don’t pay in a certain period of time. And don’t assume they will/have to pay it – expediting payment is decided on a case by case payment.

Working with Medical Providers

This is, by far, the most frustrating part. Whenever I mention we use a health share, they always know what I’m talking about…but then they treat me like I’m never actually going to pay them. Or they get confused about how it works.

Thankfully, in more recent years, this has become less of a problem, but we do get the occasional side glance or the feeling that they think we are super irresponsible.

We went to an ER once, and I swear, as soon as they heard we were “self-pay”, they did everything they could to push us out of the door as quickly as possible. Even as I tried to explain to them what we did. Anyways.

The key is to make sure you talk to the financial department as soon as possible. You need to know what they require up front. If they allow for payment plans. What discounts you can get.

I’ve found that the discounts vary substantially. Many will start with a super low 10% off – while others will start with something as high as 60% off. I will say, always negotiate if it’s low. I am always able to get at least 20%.

CHM has a team of member advocacy people who can help to negotiate discounts as well. If you have ANY issues at all with the billing department, contact CHM, and they will be able to help you.

Be aware that when you have surgery, there are LOTS of medical providers involved. For my surgery, I have gotten separate bills from:

- The hospital

- The surgeon

- The pathologist

- The anesthesiologist

- The surgical assistant

It’s kind of annoying! But just be aware that when you are using an organization like Christian Healthcare Ministries, you will likely be spending a lot of time on the phone. And it can get frustrating.

Submitting Bills with CHM

The process to submit bills for CHM is pretty easy. Initially, there are quite a few papers that you have to turn in:

- Needs Processing Form

- Needs Processing Worksheet

- HIPAA

- Letter of Explanation

- Prayer Page Form (submit only if your bill(s) is for a pre-existing condition)

As you get more bills associated with the incident, you will add those as “add-on” bills.

You need to make sure your bills have the medical codes for the procedures, show how much they charged, any discounts applied, and the total amount due.

If you do not send this, you will get a letter from CHM saying that you need to submit something else. Some medical providers send this information by default; others will require you call the billing department to get it sorted out. Make sure you get the right bills though, or else it will delay the process of getting them paid.

Getting Reimbursed with CHM

Most of the time, it is going to take 90-120 days to get payment from Christian Healthcare Ministries. They will send a check directly to you, and at that point, you will be responsible for paying the bills off.

Now, most medical providers are not going to wait 90-120 days for payment. Which means you will be responsible for paying something for 3-4 months.

CHM encourages you to apply for any financial aid programs that a hospital or medical provider may offer. This can ease that burden of a monthly payment.

We did not qualify for any of those, so we just set up payment plans for as little they would let us, and we paid that for several months for Oliver’s surgery. As soon as the money came, we paid off the remaining balances, and we were paid back as well for the amounts we paid.

With Oliver’s surgeries, there was no issue doing a payment plan on a self-pay account. However, with mine, we found that several of the medical providers would either give us a discount and are requiring we pay it all up front within a certain period of time (ranging from 10 days to 30) with no possibility of a payment plan, or we forfeit the discount.

We contacted CHM about what they wanted us to do, and they were extremely helpful in helping us navigate that situation.

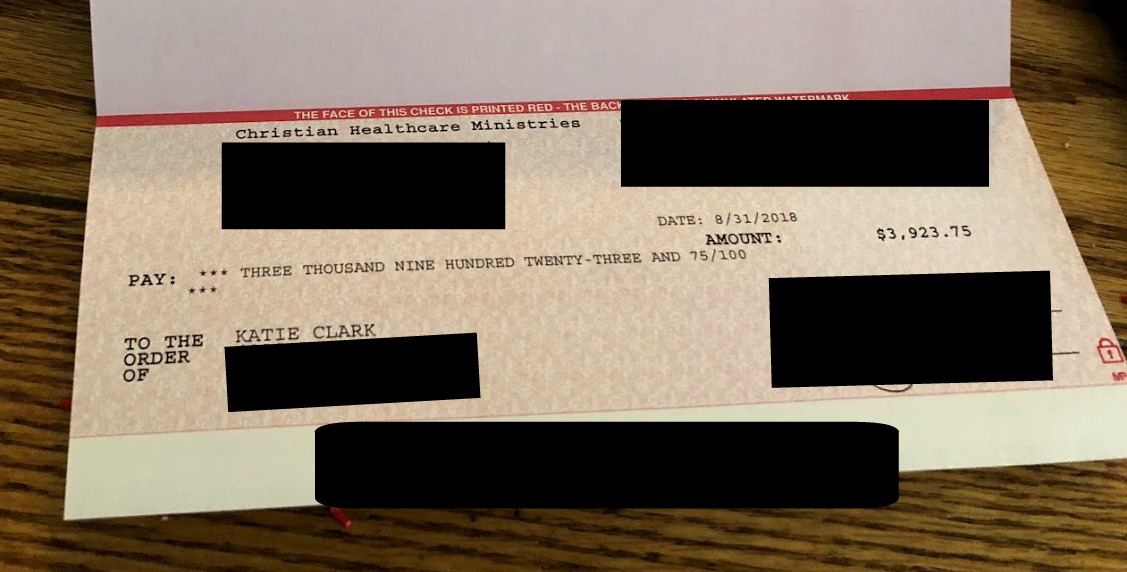

Here is a photo of one of the checks we received:

We received another check as well, but the majority of our payment was done up front due to the hospital regulations.

How Much We Ended Up Paying

When all was said and done with Oliver’s surgery, we ended up paying $0 for everything. CHM requires you pay $500 (on the Gold levels – other levels of membership are different), however, if you get enough discounts, and they add up to be over $500, they apply that to your $500 personal responsibility.

But even if you don’t get $500 in discounts for something, that’s a pretty small amount compared to most deductibles.

Our bills for Oliver’s surgery ended up being over $12,000 (with discounts applied). For me, my surgery will end up being between $25,000 and $30,000 (with discounts applied).

Overall Thoughts

We have been very pleased with CHM. It’s not a perfect system, and you do have to find ways to pay for medical expenses that aren’t shared (such as preventative care), but in our experience, it has been a much easier process than working with insurance, and it’s saved us a lot of money. It also gave me the freedom to see the specialist that I needed to see without having to deal with the red tape of “out of network” providers.

Had we had insurance, we would have been paying about $2000 a month. For this surgery, I would have had to pay around $5000 for a deductible before the insurance even paid a thing (for at least one of the surgeries – it would have definitely maxed out our deductible), and then our max out of pocket cost would have been around $12,000. That’s a lot of money!

It can be trickier to work through, but honestly, even when we had insurance, I found myself on the phone constantly trying to get things worked out. There were always bills that were overcharged or payments that they didn’t apply correctly. Once I even started getting bills for someone who had somehow gotten a hold of my insurance card #truestory.

If you have a lot of bills under $500 (which are not eligible), then CHM may not be the best option either.

We’ve had to figure out “the system” a little bit – we use a direct pay physician who we pay a monthly fee for unlimited visits and discounts on medical tests. We use Healthcare Bluebook pretty frequently to make sure we aren’t being charged more than is reasonable. I’ve researched the cheapest urgent care options in the area. So it does take some time. But I am grateful that we have this option, and it has worked really well for us.

CHM is also a BBB+ Accredited charity, and they’ve paid out over 1 billion dollars in shared medical bills.

Is a health share right for you?

You may have access to better insurance – whether because of getting a group insurance rate from work or because you get some kind of credit through the ACA. And I would encourage you to make sure that a health share like CHM is right for you – I would always recommend going with the option that will be the least expensive for your family. And that may not be the case for everyone.

CHM isn’t right for everyone – and that’s okay. We have put together this great health share comparison to help you find the right one for you. I’m not trying to convince everyone to join, because it’s not always realistic. If you have major medical issues that require a lot of monthly fees, it probably isn’t the best option.

Although CHM will pay a certain amount each year for the first three years for pre-existing conditions (and three years, it’s no longer considered pre-existing), there are certain stipulations on this. So make sure you are aware of all of this BEFORE you signup. I strongly suggest reading their member guidelines thoroughly. I’ve seen people claim they won’t pay their bills – but if they are eligible, they will pay them.

Also be aware that CHM does not pay for alternative treatments, such as acupuncture. Other similar organizations do – such as Liberty Healthshare – but CHM does not.

If you are not religious, you won’t be able to join CHM. We found their “faith requirements” to be less stringent than some, however, you still need to have some kind of religious belief.

Other Posts You May Enjoy:

Katie is a Colorado-native, BYU graduated, and most importantly, wife to one and mother to three beautiful boys. She is passionate about sharing her experiences with others – especially about pregnancy, breastfeeding, cooking, and crafts. She is an International Board Certified Lactation Consultant. She loves spending time with her family and helping others find joy in family life.

Elyssa says

Thanks for the great info! I am actually trying to plan for endometriosis surgery too and am in the same situation, they want $16,000 up front for a 75% discount. I didn’t think CHM would pay up front, I have been concerned they may decline if they consider endometriosis pre-existing, though I’ve never been diagnosed.

Cindy says

At the first of March, I signed up for Christian Healthcare Ministries, as I was losing my insurance as of the end of the month. I requested that my coverage start on March 15th so that I would be sure to have continuous coverage.

On the morning of March 15th, I had some tree trimmers working in my yard, trimming some branches off of a tree. I walked out in my yard to see how it was going, but thought I was far enough away to be safe, about 40 feet from the tree. Unfortunately, I was almost instantly hit on the back of my head by a falling branch, as I was still walking away from the tree, ending up with an ambulance trip to the hospital and an ER visit. I guess I will have the opportunity to find out early on how this coverage works, as soon as I get my itemized bills. I should still be covered by my Obamacare insurance, as it wasn’t due to end until March 31, so the CHM bills shouldn’t be nearly as much as they would have been otherwise, but it will be interesting to see how it works.

Danielle says

Hello fellow Coloradan! In googling how to write my letter of explanation to CHM, I came across this post. I recently had surgery and am preparing everything to submit to CHM for my claim. Even though we have been members for almost three years, this will be our first time sharing our bills. I am curious what you needed to include in the letter of explanation? For some reason, that’s the thing that’s holding me up. I just don’t know what to write! Any insight you have would be helpful.

Katie says

Hi! I just tried to be as detailed as possible – what caused me to seek out surgery, when the symptoms started, etc. I just tried to provide any details possible that I thought they might have questions about. They didn’t ask any questions, so I think I did a good job explaining (I probably overexplained!)

Danielle says

Thank you!

Kelsey says

Katie. THANK you for this post. It is thorough, clear, and SO helpful! I’m so glad it worked for you!!!! I have the gold plan & brothers keeper. It gives me peace of mind having it, we just haven’t had to use it yet. I had a little health scare that almost meant us going to the hospital

And I got nervous about using CHC. This is what led me to your blog so I at least had some clarity on the process it’s been for others. Thank you so much for taking the time to write and share your story! I wish more people looked into the guidelines and understood how it works bc I truly do think CHC is so great, but it gets thrown under the bus bc people think it works just like insurance and they bash it when they go to use it not understanding how it fully works. I hope y’all are doing and feel well! Thanks again!

Katie says

Hi, Kelsey! Thanks so much for taking the time to comment. I’m so glad that this was helpful to you. And I agree – I think a lot of people just don’t understand how it works. I see so many people saying it’s a scam or they don’t pay bills…when in reality, it’s because they didn’t take the time to read about it! Have a wonderful day 🙂

Lora says

Hi Katie. Did your son’s ear tube surgery not qualify as a pre-existing condition? My son just had tubes placed and I am worried it will be denied for that reason.

Katie says

Hi, Lora:

No, it didn’t. We explained in detail his history – he had passed his hearing tests for quite some time, and it wasn’t until later on in life that it seemed his hearing was being impacted, which was after we had signed up for him. I would imagine it will be different depending on the situation – if your son has had issues from birth, it likely will fall under the pre-existing condition clause, though with that, you may still get help depending on the situation (or they may require you go the prayer route). I would say it’s worth talking to them about.

D. Pat Didear says

Thank you for the article on CHM, of which my wife and I are members. We have only had one qualifying incident so far, and being septuagenarians, we still have a good degree of potential to use their services. We, too are Gold Members, plus Brothers Keepers.

I found your article quite informative, and it confirms my own experiences.

I have sometimes, while paying my monthly bills – and especially while waiting for my first check, had doubts as to whether I am out on a lonely limb trusting in a system I have no control over. Reading what you have written has relieved my doubts. Thank you for sharing this with us. God Bless you.

(Photos of your boys made me smile.)

Katie says

Thanks for commenting! I’m so glad that you found this helpful – it’s so easy to feel a little skeptical! But it really has been a wonderful thing for our family. I’m glad it’s something that works well for you, too! Have a great day 🙂